Accounting clerks do many different tasks within an organization. This job requires an in-depth knowledge of financial documents and methods, payroll administration and business practices, regulations and taxation, as well as a strong sense of ethics. As an accountant, they must be well-versed in various accounting practices, communication methods, and marketing techniques. These are the common job responsibilities. Find the right career path by reading on. You may be interested in this career path if you have the education and potential earning potential.

Environment for work

Entry-level tasks are part of the job description for an accounting clerk. These clerks work in a computer environment and input data. Accuracy is crucial because they deal with numbers. Focus on details is also a must. It is essential to have organizational skills. Accounting clerks must be able to manage multiple projects and meet deadlines. They also need to keep track of many tasks. The work environment of an accounting clerk is varied.

Accounting clerks spend their day dealing with clients, updating records, filing paperwork, and running reports. Accountants who work in this field are often required to multitask and be able perform under pressure. A degree in accounting could help you land the job that you desire. Be sure to read up on job descriptions to find the best one for you. Here are some of the many advantages that accounting clerks have.

Education required

The education requirements for accounting clerks vary depending on the job. A high school diploma or the General Equivalency Diploma is required for most jobs in this field. Some advanced accounting clerks also have associate degrees, although not all of them will need a bachelor's degree. Those with a CPA credential are also in high demand. While there is no set education requirement for a position as an accounting clerk, it is recommended that you have a solid understanding of accounting software.

Many high-profile employers prefer candidates with a two-year associate's degree in accounting or finance. For entry-level position as an accounting clerk, high school diplomas suffice. But, it is possible to distinguish yourself by furthering your education. An evening class is available to teach computerized accounting programs. Students can earn an associate's in accounting. Volunteering is another great way to get experience while working towards your degree.

The future of work

You'll be performing many tasks as an accounting clerk. Most tasks you'll perform as an accounting clerk include computations, data crunching and communication with other parties. If you have special skills, you could earn a higher salary. Accounting clerk jobs can be varied and have many responsibilities. Below are the essential skills accounting clerks must have. You can also earn a higher salary if you're trained in specific technical skills, such as payroll processing or server work.

A majority of accounting clerks have only a high school diploma, but it is still beneficial to pursue a higher education. Some accounting clerks take night courses to learn computerized accounting software. However, it's not a requirement to go to college to become an accounting clerk. Volunteering is a great way to gain practical experience. Burning Glass Technologies estimates a 10% growth in demand for accounting clerks through 2022. There is also room for advancement, as many of the jobs in this sector are entry level.

Requirements

There are many skills required to be an accounting clerk. They must have strong attention to detail and an aptitude for math. You will need to be able to work with Microsoft Office Suite and spreadsheets. Accounting clerks may be required to handle general office tasks like answering phones, filing mail, sorting mail, or answering customers' questions. An average Accounting Clerk salary in the United States is $38,900 a year.

Accounting Clerks usually receive on-thejob training. They will learn double-entry accounting, which requires entering transactions twice to ensure they balance out. They may also require classroom training to learn how to use computer software. The on-the job training is usually six months long, regardless of the type of training. A Bachelor's degree or equivalent in accounting is not required to apply for this position. However it may help applicants understand the basics of accounting.

FAQ

How long does it take for an accountant to become one?

The CPA exam is necessary to become an accountant. Most people who want to become accountants study for about 4 years before they sit for the exam.

After passing the test one must have worked for at minimum 3 years as an Associate before becoming a Certified Public Accountant (CPA).

What is the difference between bookkeeping and accounting?

Accounting is the study of financial transactions. The recording of these transactions is called bookkeeping.

They are both related, but different activities.

Accounting deals primarily on numbers, while bookkeeping deals mostly with people.

For reporting purposes on an organization's financial condition, bookkeepers keep financial records.

They make sure all of the books balance by adjusting entries in accounts payable, accounts receivable, payroll, etc.

Accountants analyze financial statements to determine whether they comply with generally accepted accounting principles (GAAP).

If not, they may recommend changes to GAAP.

Accounting professionals can use the financial transactions that bookkeepers have kept to analyze them.

How do I know if my company requires an accountant?

Many companies hire accountants after reaching certain levels. One example is a company that has annual sales of $10 million or more.

However, there are some companies that hire accountants regardless if they have a small business. These include small companies, sole proprietorships as well partnerships and corporations.

A company's size does not matter. Only what matters is whether or not the company uses accounting software.

If it does, then the accountant is needed. If it doesn’t, then it shouldn’t.

What is an audit?

An audit involves a review and analysis of a company's financial statements. Auditors examine the company's books to verify everything is correct.

Auditors check for discrepancies and contradictions between what was reported, and what actually occurred.

They also examine whether financial statements for the company have been properly prepared.

How do accountants work?

Accountants work with clients in order to get the best out of their money.

They work closely with professionals such as lawyers, bankers, auditors, and appraisers.

They also work with internal departments like human resources, marketing, and sales.

Accountants are responsible for ensuring that the books are balanced.

They determine the tax due and collect it.

They also prepare financial reports that reflect how the company is doing financially.

Why is reconciliation important

This is important as you never know when errors might occur. Mistakes include incorrect entries, missing entries, duplicate entries, etc.

These problems could have severe consequences, such as incorrect financial statements, missed deadlines or overspending.

What happens if my bank statement isn't reconciled?

It's possible that you won't realize it until the end if your bank statement isn't in order.

You will have to repeat the whole process.

Statistics

- a little over 40% of accountants have earned a bachelor's degree. (yourfreecareertest.com)

- "Durham Technical Community College reported that the most difficult part of their job was not maintaining financial records, which accounted for 50 percent of their time. (kpmgspark.com)

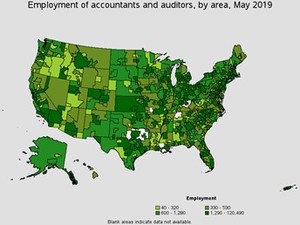

- Employment of accountants and auditors is projected to grow four percent through 2029, according to the BLS—a rate of growth that is about average for all occupations nationwide.1 (rasmussen.edu)

- BooksTime makes sure your numbers are 100% accurate (bookstime.com)

- According to the BLS, accounting and auditing professionals reported a 2020 median annual salary of $73,560, which is nearly double that of the national average earnings for all workers.1 (rasmussen.edu)

External Links

How To

Accounting for Small Business

Accounting is an essential part of managing any business. This involves tracking income and expenses as well as preparing financial reports and tax payments. You may also need to use software programs like Quickbooks Online. There are many options for accounting small businesses. You must choose the right method for you, based on your requirements. Below is a list of top methods that we recommend.

-

Use the paper accounting system. You may prefer paper accounting if you are looking for simplicity. This method is very simple. All you need to do is keep track of all transactions. You might consider investing in an accounting software like QuickBooks Online if you want your records to be accurate and complete.

-

Online accounting. Using online accounting means that you can easily access your accounts at any time and anywhere. Wave Systems and Freshbooks are three of the most widely used options. These types of software allow you to manage your finances, pay bills, send invoices, generate reports, and much more. They are easy to use, have great features, and many benefits. These programs are great for saving time and money in accounting.

-

Use cloud accounting. Cloud accounting is another option. You can store your data securely on a remote server. When compared to traditional accounting systems, cloud accounting has several advantages. First, it does not require you to buy expensive hardware or software. Second, it offers better security because all your information is stored remotely. It takes the worry out of backups. Fourth, it makes sharing files easier.

-

Use bookkeeping software. Bookkeeping software can be used in the same manner as cloud accounting. But, it is necessary to purchase a new computer and install it. After you install the software, you'll be able connect to the internet and access your accounts whenever you wish. You will also have the ability to access your accounts and balances directly from your PC.

-

Use spreadsheets. Spreadsheets are useful for entering financial transactions manually. A spreadsheet can be used to record sales figures for each day. You can also make changes whenever you like without needing to update the whole document.

-

Use a cash book. A cashbook allows you to record every transaction. Cashbooks come in different sizes and shapes depending on how much space you have available. You have the option of using a different notebook for each month, or a single notebook that covers several months.

-

Use a check register. A check register can be used to organize receipts, payments, and other information. Simply scan your items into your scanner to transfer them to the check register. Notes can be added to the items once they are scanned.

-

Use a journal. Journals are a logbook that helps you keep track of your expenses. This is a good option if you have lots of recurring expenses like rent and insurance.

-

Use a diary. Keep a journal. You can use it for tracking your spending habits or planning your budget.